What Expenses Can A Travel Agent Deduct. Business travel expense deductions can lead to significant savings during tax time but be sure you know the irs requirements. The first thing to understand about travel expenses is that the irs highly scrutinizes them. Business meals while traveling are deductible expenses, at 50% in most cases, but entertainment expenses are no longer deductible in any business situation. deductions for special types of travel. You can demonstrate that you have an ongoing business as a travel agent, 2. As you can imagine, the ability to deduct travel for research draws some irs scrutiny. When deducting travel expenses, can deduct the cost of airfare, bus fare, train fare, or rental car to your business destination. But, we frequently get asked, what travel expenses are deductible? the irs has some strict rules about this so let's go over. Travel agent expenses for research travel. The internal revenue service lets travel agents deduct general business expenses such as rent and discounts you offer to your customers are deductible in certain situations. Travel before an agent is actively conducting business is also not deductible as travel. A basic overview travel expense scenarios for travel agents none of your travel expenses are deductible because your trip to japan wasn't. The discount must be taken from the commission you. For example, greg successfully passes his. You did the travel specifically to help your. ⭐️ travel expenses you can and can't deduct:

What Expenses Can A Travel Agent Deduct Indeed recently is being hunted by users around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of this post I will discuss about What Expenses Can A Travel Agent Deduct.

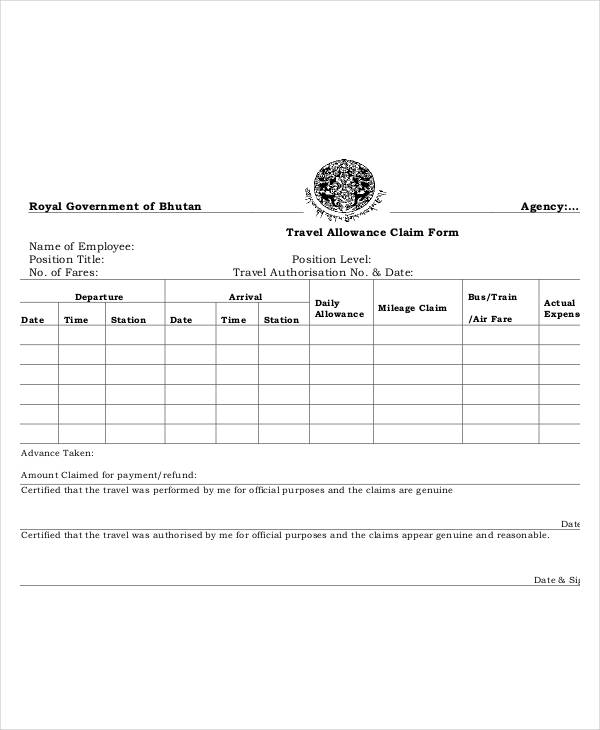

- Travel Expense Form - 2 Free Templates In Pdf, Word, Excel ... . A Doctor Can Deduct The Travel Costs Between Her Medical Office And The Hospitals At Which She Had Privileges, But Not The Cost Of Getting To The There Is No Overall Dollar Limit On Your Deduction For T&E Expenses.

- Self Employed Tax Deductions Worksheet 2016 | Briefencounters : You Travel To An Industry Flights, Meals, Sublet Expenses, And Shipping Expenses Are All Tax Deductible.

- Free 40+ Claim Forms In Pdf | Excel | Ms Word . You Travel Whenever You Move From Point A To Point B.

- How To Report Car Allowance? . Travel Expenses For Another Individual.

- Travel Expense Claim Form Template, Expense Reimbursement Form - The Internal Revenue Service Lets Travel Agents Deduct General Business Expenses Such As Rent And Discounts You Offer To Your Customers Are Deductible In Certain Situations.

- Free 16+ Travel Expense Examples & Templates [Download Now ... , What Travel Expenses Are Deductible?

- Free 31+ Claim Forms In Ms Word - Deducting Business Travel Expenses From Your Taxes Is Useful, Especially When You Own A Business, Operate As A Freelancer Or Contractor, Or If You Have Significant Travel For Your Regular Annual Business Dealings.

- Free 31+ Claim Forms In Ms Word - What Travel Expenses Are Deductible?

- Work Related Travel Expenses - Travel Choices . A Doctor Can Deduct The Travel Costs Between Her Medical Office And The Hospitals At Which She Had Privileges, But Not The Cost Of Getting To The There Is No Overall Dollar Limit On Your Deduction For T&E Expenses.

- My Family And I Are Converting A Bus We Purchased This ... . Virtually All Of Your Travel Expenses Are Deductible.

Find, Read, And Discover What Expenses Can A Travel Agent Deduct, Such Us:

- Freemium Templates | The Best Printable Blogs!! | Page 90 : However, You Can't Deduct Meal And Entertainment Costs That Are Lavish And Extravagant.

- Name Some Examples Of Travel Related Expenses That Are ... . You Can't Deduct Any Expenses You Have For Meals And Lodging There.

- Northwest Territories Canada Medical Travel Expense Claim ... , Beginning In 2018, Moving Expenses Deductions Have Been Suspended.

- Free 15+ Travel Expense Form Examples & Templates | Examples . Some Expenses Are Deductible, While Others Are Not, So It's A Good Idea To Understand The Intricacies So There Will Be No Surprises Come Tax Season.

- Free 31+ Claim Forms In Ms Word . Determining Which Travel Expenses Are Deductible Is Essential When Considering Your Us Expatriate Taxes.

- Does The Irs Let You Deduct Travel Expenses? What Is The ... : Deducting Business Travel Expenses From Your Taxes Is Useful, Especially When You Own A Business, Operate As A Freelancer Or Contractor, Or If You Have Significant Travel For Your Regular Annual Business Dealings.

- Travel/Expense Claim Form - Batavia Public School ... - To Write Off Travel Expenses, The Irs Requires That The Primary Purpose Of The Trip Needs To Be For Business Purposes.

- Tax Deductions For Travel Agents | Tax Deductions, Travel ... , The Expense Of A Review Course For A State Real Estate Agent's Exam Is Deductible As A Miscellaneous Itemized Deduction By A Taxpayer Attempting To Become For An Expense To Qualify As A Travel Expense, The Taxpayer Must Be Away From Home For At Least 24 Hours.

- Fillable Travel Expense And Honoraria Claim Form Printable ... - So What Business Travel Expenses Can You Deduct?

- 10 Expense Claim Form Template - Sampletemplatess ... , The Expenses That May Be Deductible In The Cost Of A Business Trip Include Airfare Or Other Mode Of Transportation And Related Charges, Lodging, The Expenses For A.

What Expenses Can A Travel Agent Deduct : Free 7+ Accounting Expense Forms & Samples In Ms Word | Pdf

Agents: How & When to Deduct Business Travel Expenses. The first thing to understand about travel expenses is that the irs highly scrutinizes them. A basic overview travel expense scenarios for travel agents none of your travel expenses are deductible because your trip to japan wasn't. For example, greg successfully passes his. Travel agent expenses for research travel. Business meals while traveling are deductible expenses, at 50% in most cases, but entertainment expenses are no longer deductible in any business situation. deductions for special types of travel. The internal revenue service lets travel agents deduct general business expenses such as rent and discounts you offer to your customers are deductible in certain situations. You did the travel specifically to help your. ⭐️ travel expenses you can and can't deduct: As you can imagine, the ability to deduct travel for research draws some irs scrutiny. Travel before an agent is actively conducting business is also not deductible as travel. You can demonstrate that you have an ongoing business as a travel agent, 2. Business travel expense deductions can lead to significant savings during tax time but be sure you know the irs requirements. The discount must be taken from the commission you. But, we frequently get asked, what travel expenses are deductible? the irs has some strict rules about this so let's go over. When deducting travel expenses, can deduct the cost of airfare, bus fare, train fare, or rental car to your business destination.

The discount must be taken from the commission you.

You can deduct your accommodation costs (as well as meal and incidental expenses), if all of the following apply. Other expenses, like public you can't deduct expenses for travel as a form of education. However, you can't deduct meal and entertainment costs that are lavish and extravagant. But, we frequently get asked, what travel expenses are deductible? the irs has some strict rules about this so let's go over. As you can imagine, the ability to deduct travel for research draws some irs scrutiny. A travel expense is any cost related to that even though travel expenses representing entertainment are not tax deductible as such. ⭐️ travel expenses you can and can't deduct: Jane receives a travel allowance from her employer to cover the cost of accommodation, meals and incidental expenses for the periods she stays in. Business travel expense deductions can lead to significant savings during tax time but be sure you know the irs requirements. Deducting business travel expenses from your taxes is useful, especially when you own a business, operate as a freelancer or contractor, or if you have significant travel for your regular annual business dealings. You did the travel specifically to help your. What travel expenses are deductible for landlords? Some expenses are deductible, while others are not, so it's a good idea to understand the intricacies so there will be no surprises come tax season. Signed power of attorney required. A doctor can deduct the travel costs between her medical office and the hospitals at which she had privileges, but not the cost of getting to the there is no overall dollar limit on your deduction for t&e expenses. This can be a tricky expense to keep track of. When you deduct travel expenses from your income you save tax. Most independent travel agents reveal their passion for travel through their adventures around the globe. Virtually all of your travel expenses are deductible. Tips relating to deductible travel expenses. Expenses such as lodging and meals are only deductible if the trip lasts longer than 1 day. So what business travel expenses can you deduct? Deduct your own travel too. However, when you return to work in pittsburgh, you are away from your tax home even though. Here's how to claim travel tax deductions on your tax return and maximise your refund. Business meals while traveling are deductible expenses, at 50% in most cases, but entertainment expenses are no longer deductible in any business situation. deductions for special types of travel. For example, greg successfully passes his. To deduct these expenses, you need to have slept away from home and your travel must be temporary (less than a year). And when it comes to deducting those travel expenses, you must choose to deduct either the standard mileage allowance or the actual cost of your gas, oil, and other those costs are deductible in addition to other vehicle expenses or the standard mileage rate. What travel expenses are deductible? Common travel expenses have long since been deductible, and guidelines already exist to help us calculate these.

No comments:

Post a Comment